Unknown Facts About Feie Calculator

Table of ContentsFeie Calculator for BeginnersSome Known Details About Feie Calculator About Feie CalculatorLittle Known Facts About Feie Calculator.Feie Calculator Fundamentals Explained

He marketed his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his partner to help meet the Bona Fide Residency Examination. Neil points out that purchasing property abroad can be challenging without very first experiencing the place."It's something that individuals need to be truly attentive about," he claims, and advises expats to be careful of usual blunders, such as overstaying in the United state

Neil is careful to mindful to Stress and anxiety tax united state that "I'm not conducting any performing in Illinois. The U.S. is one of the few nations that tax obligations its residents no matter of where they live, indicating that also if an expat has no revenue from U.S.

tax return. "The Foreign Tax obligation Credit score enables individuals functioning in high-tax countries like the UK to offset their U.S. tax obligation liability by the amount they've currently paid in taxes abroad," claims Lewis.

All about Feie Calculator

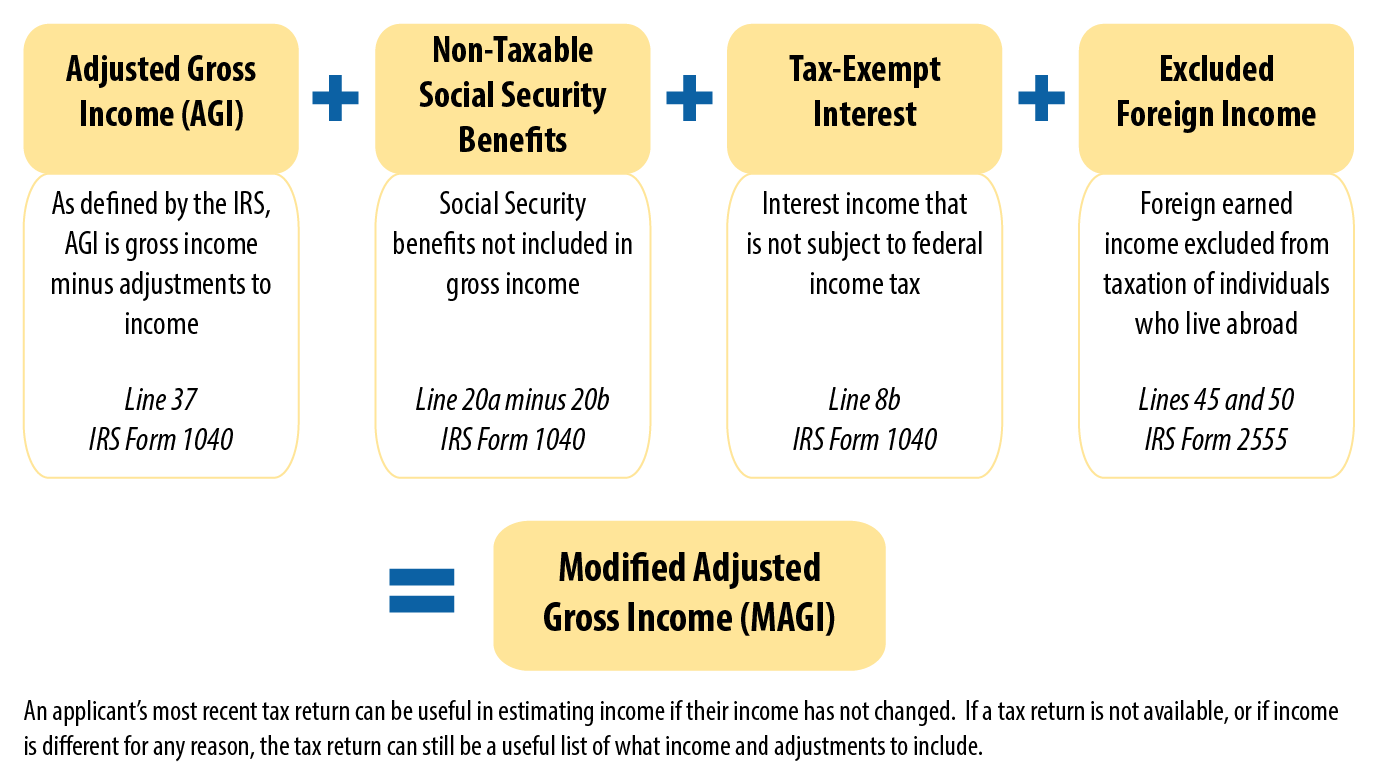

Below are some of the most frequently asked concerns regarding the FEIE and various other exemptions The International Earned Income Exemption (FEIE) permits united state taxpayers to omit approximately $130,000 of foreign-earned revenue from government earnings tax obligation, lowering their united state tax liability. To get FEIE, you need to satisfy either the Physical Visibility Examination (330 days abroad) or the Authentic House Examination (confirm your key house in an international country for a whole tax obligation year).

The Physical Existence Test likewise requires U.S (FEIE calculator). taxpayers to have both a foreign earnings and an international tax obligation home.

Some Known Facts About Feie Calculator.

An income tax obligation treaty in between the U.S. and one more nation can assist avoid double taxes. While the Foreign Earned Income Exemption reduces gross income, a treaty might provide added benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Report) is a called for filing for U.S. people with over $10,000 in foreign economic accounts.

Eligibility for FEIE relies on meeting details residency or physical visibility tests. is a tax obligation consultant on the Harness system and the owner of Chessis Tax. He belongs to the National Organization of Enrolled Representatives, the Texas Society of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a decade of experience benefiting Big 4 firms, suggesting migrants and high-net-worth people.

Neil Johnson, CPA, is a tax obligation expert on the Harness platform and the creator of The Tax obligation Guy. He has more than thirty years of experience and currently specializes in CFO solutions, equity payment, copyright taxes, marijuana taxation and divorce relevant tax/financial planning issues. He is a deportee based in Mexico - https://www.pubpub.org/user/feie-calculator.

The foreign gained revenue exclusions, sometimes described as the Sec. 911 exemptions, exclude tax on salaries earned from working abroad. The exclusions comprise 2 components - a revenue exemption and a housing exclusion. The following FAQs talk about the benefit of the exclusions including when both partners are expats in learn this here now a basic manner.

Fascination About Feie Calculator

The tax benefit omits the earnings from tax obligation at bottom tax rates. Previously, the exclusions "came off the top" reducing earnings topic to tax at the top tax rates.

These exemptions do not exempt the wages from United States taxes yet simply offer a tax reduction. Keep in mind that a solitary individual functioning abroad for every one of 2025 that made about $145,000 without any various other income will certainly have gross income reduced to zero - properly the exact same solution as being "free of tax." The exclusions are computed on a daily basis.